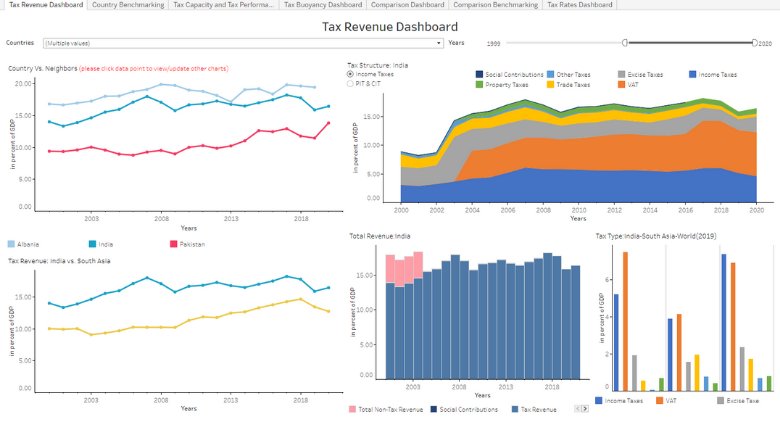

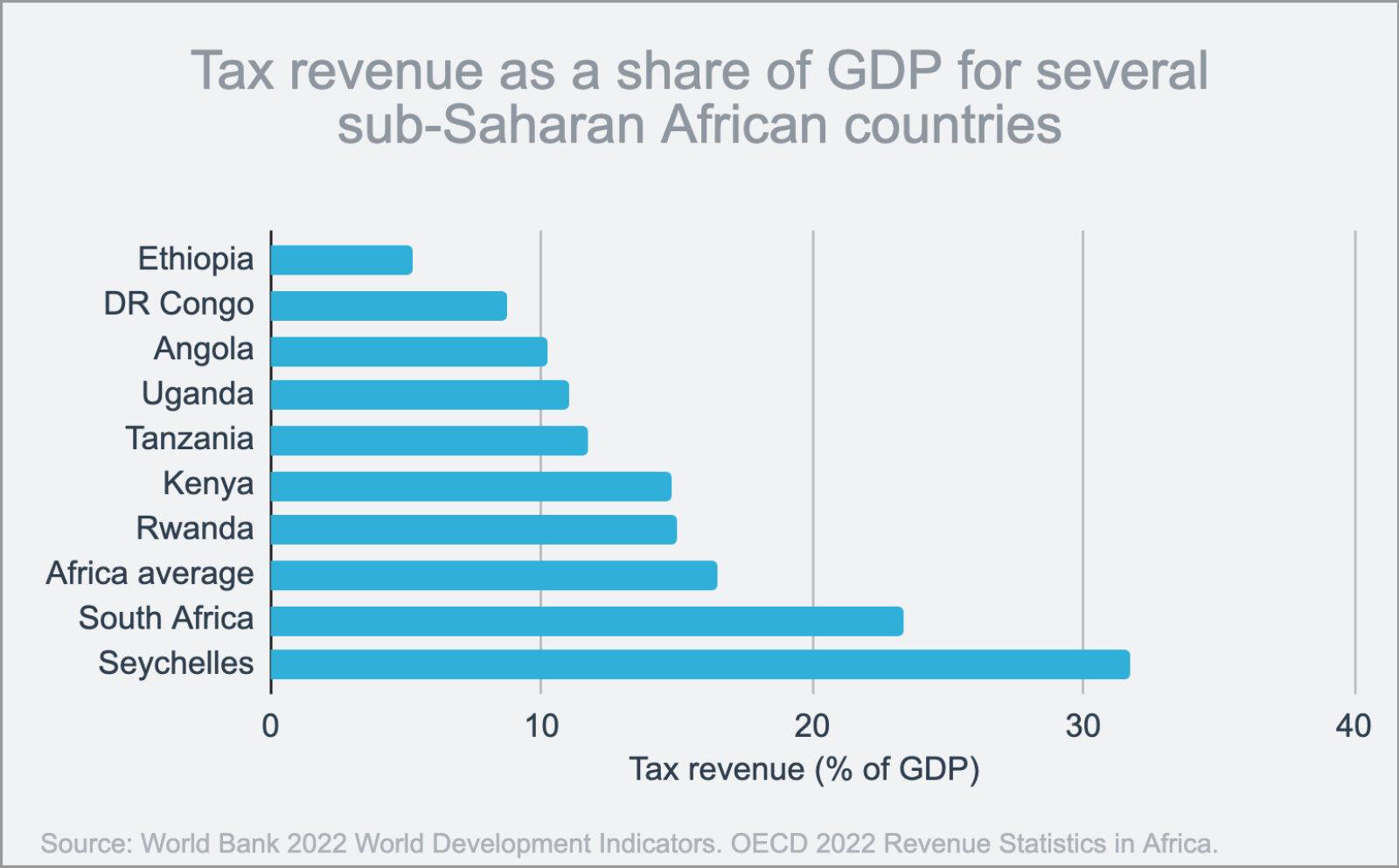

Adam Tooze on Twitter: "African tax gap: @IMFNews models “tax capacity” using variables such as GDP/capita, trade openness & governance -> thinks that African governments could increase revenues by 3-5% GDP =

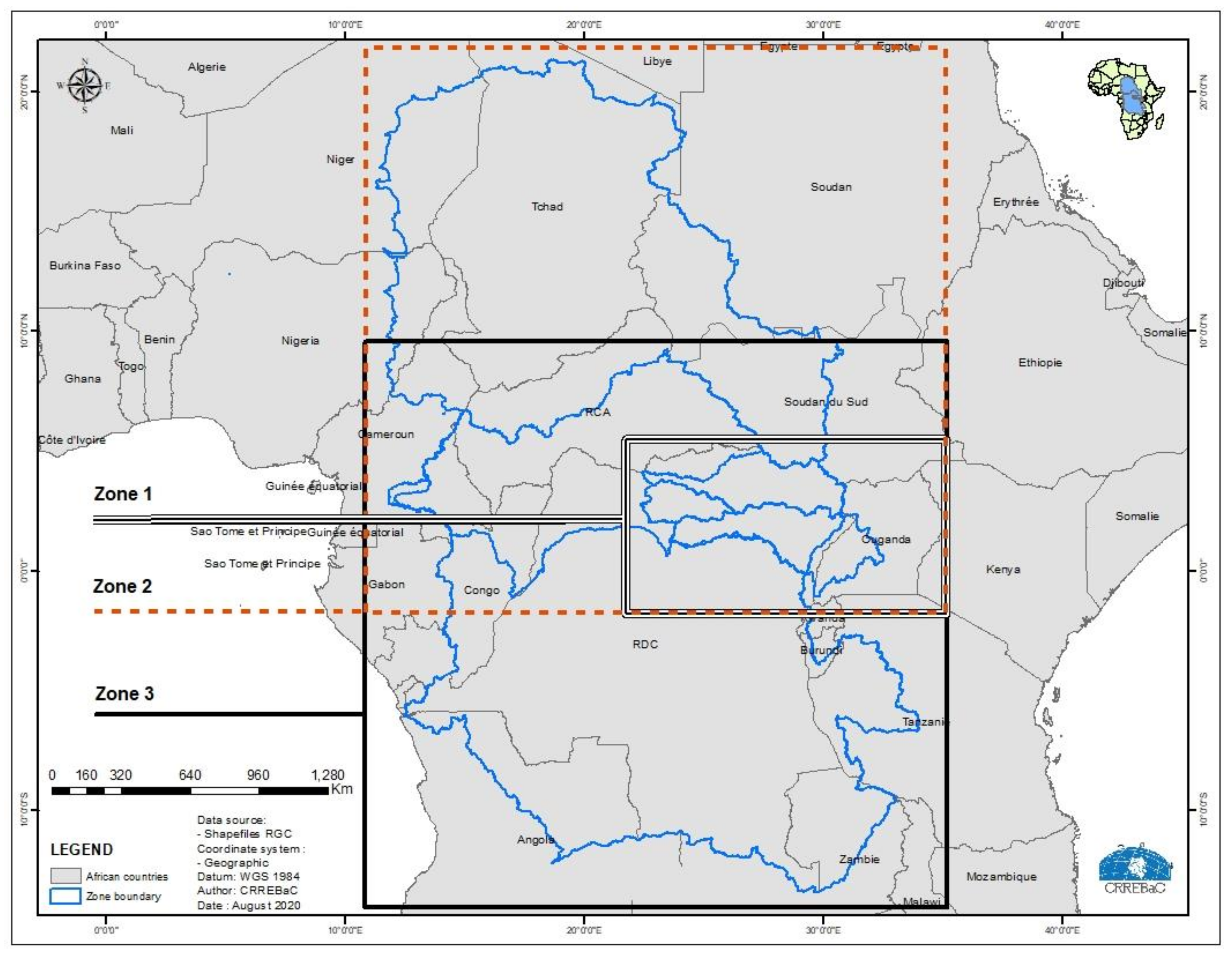

Sustainability | Free Full-Text | An Integrated Information System of Climate-Water-Migrations-Conflicts Nexus in the Congo Basin

Dancing in the Glory of Monsters: The Collapse of the Congo and the Great War of Africa: Stearns, Jason: 9781610391078: Amazon.com: Books

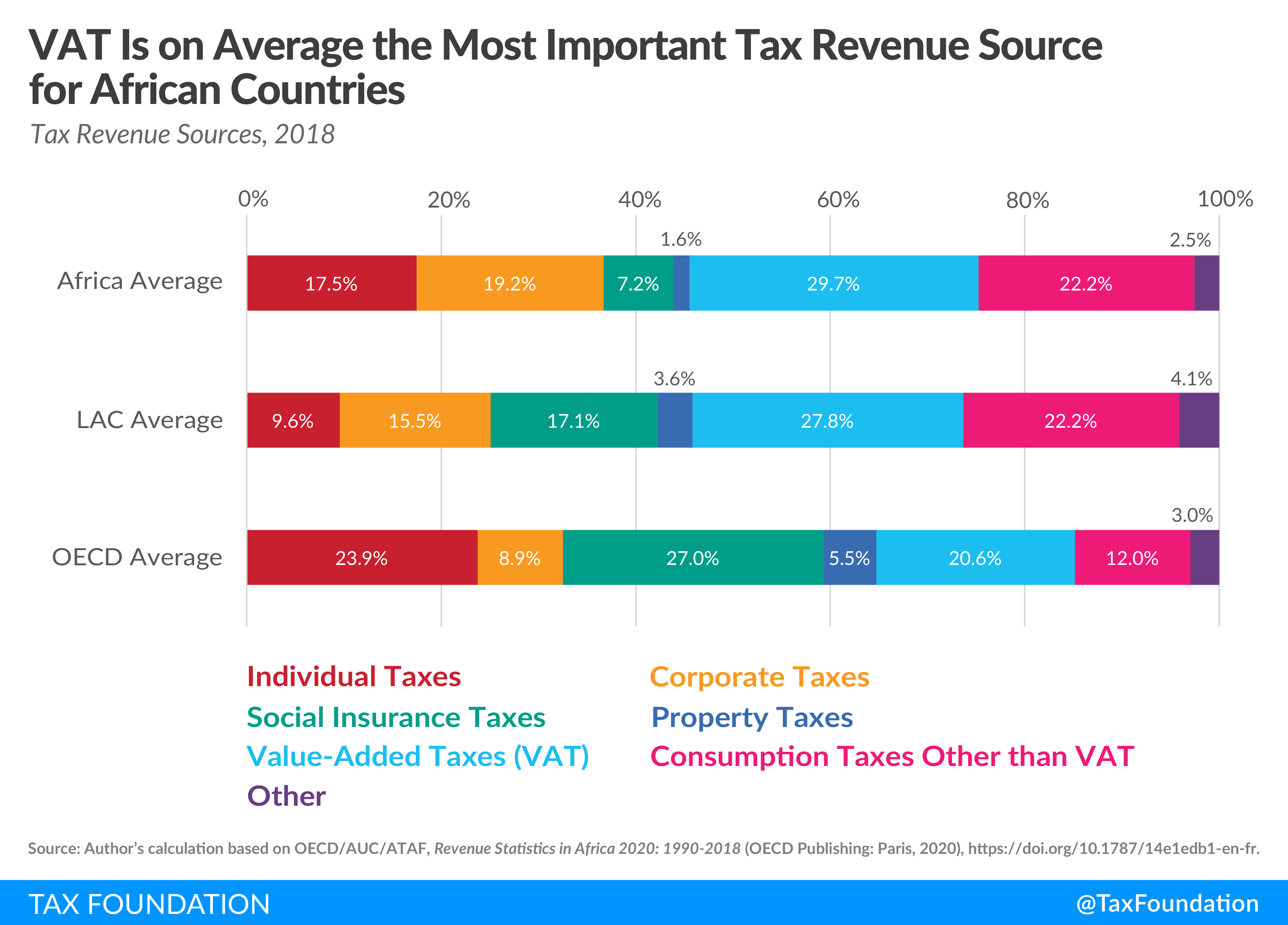

In Sub-Saharan Africa, Tax Revenue as Share of GDP Lags Behind Other Regions – BRINK – Conversations and Insights on Global Business

The Indigenous World 2022: Democratic Republic of the Congo (DRC) - IWGIA - International Work Group for Indigenous Affairs

The Participation Dividend of Taxation in DRC and Beyond: Recent Evidence and Paths for Future Inquiry – ICTD

Protected areas: a pathway to sustainable growth in the Democratic Republic of Congo | Projects | WWF